Beeple’s “Golden Dog” in the NFT Winter: Breaking the Mold with an Algorithmic Robot Dog

Con ongple, the man who sold a single NFT for a record-breaking $69 million, has long been regarded as a symbol of the beginning of the golden age of NFT.

Despite the decline of NFTs, beeple and his team remain active in the NFT community. At this year’s Art Basel, he brought another “golden dog” to the currently sluggish NFT market—Regular Animals.

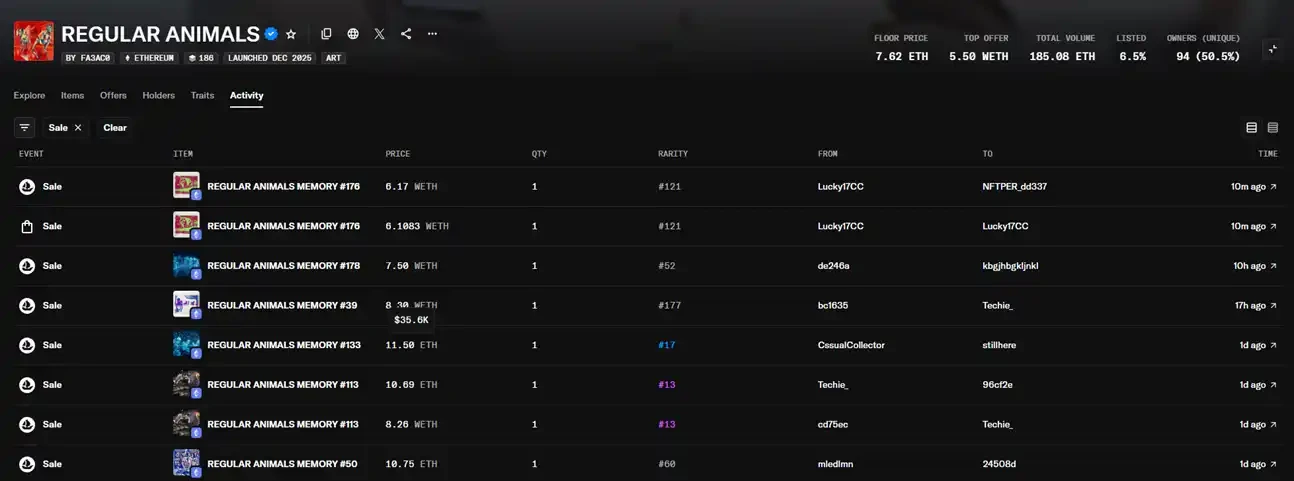

Yesterday, several Regular Animas paintings sold for over 10 ETH (approximately $35,000 USD) on OpenSea. These works were given away for free at Art Basel, totaling 256 pieces. Based on this price, Beeple gave away nearly ten million USD worth of NFTs at Art Basel.

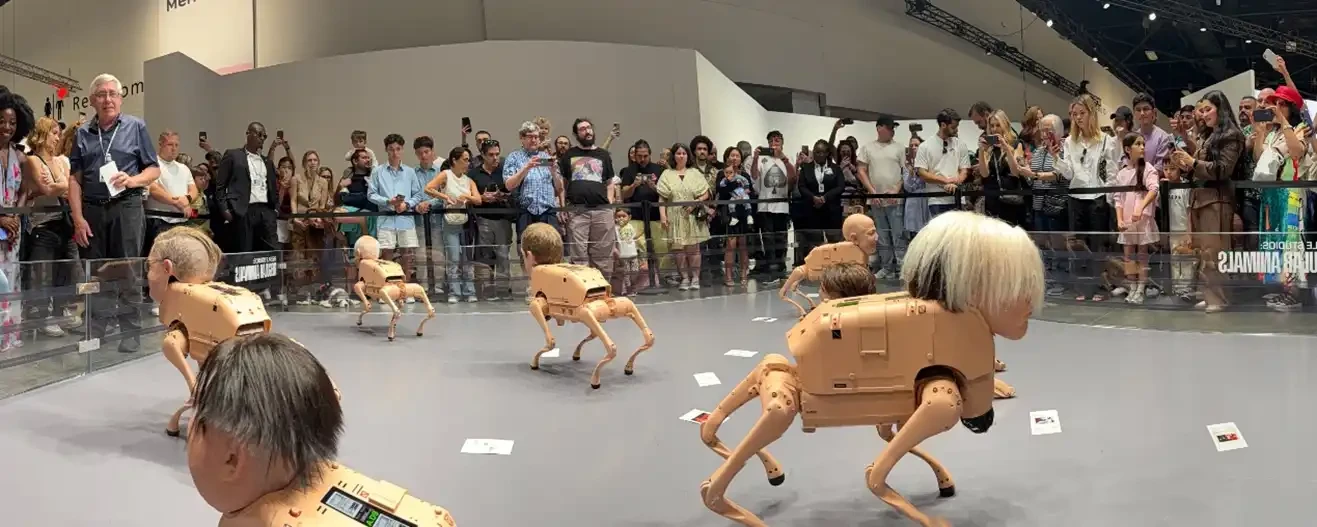

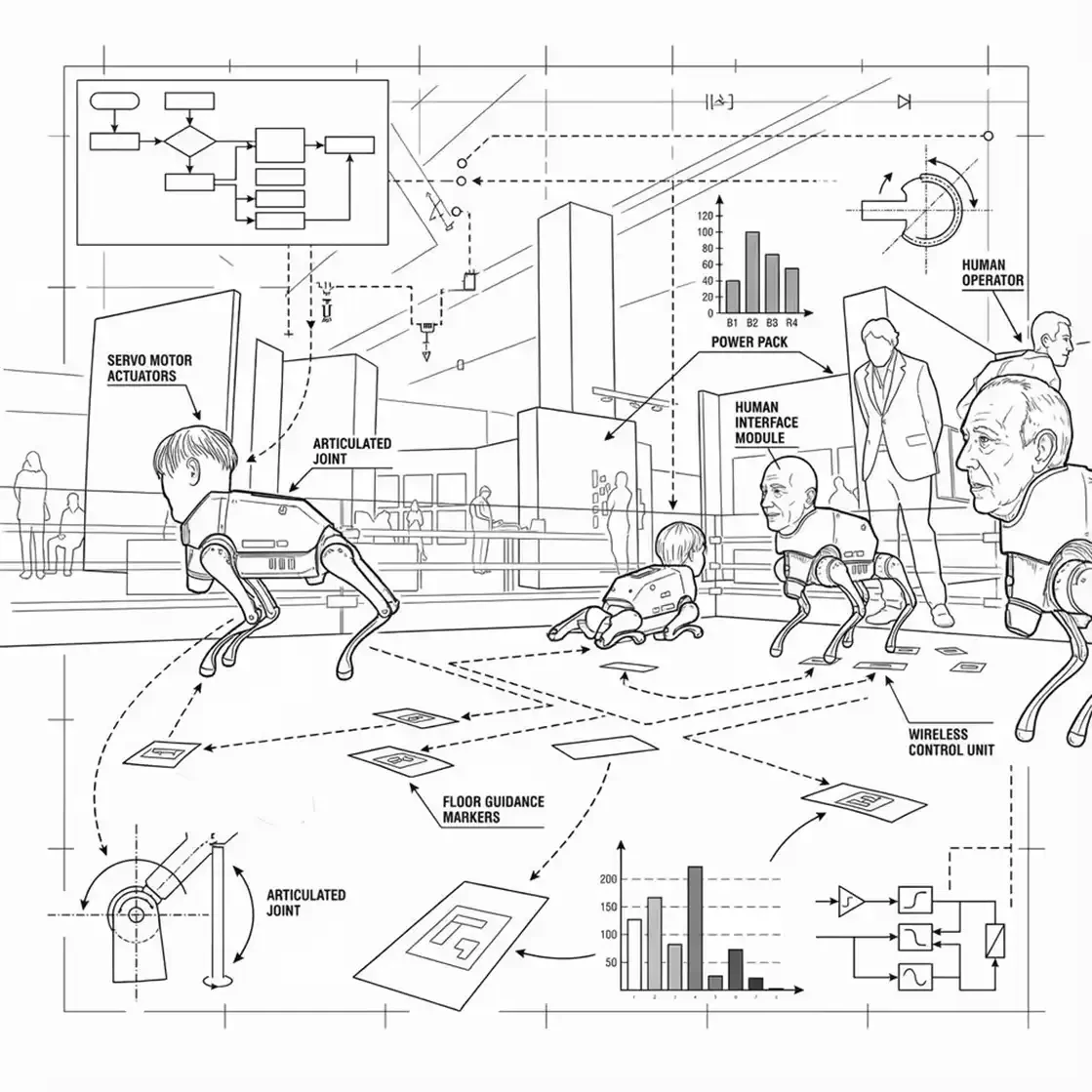

Beeple and his team’s project for this year’s Art Basel is Regular Animas. It’s a collection of robotic dogs, as shown in the image below. They look a bit creepy because these robotic dogs have human faces, and they’re based on famous figures such as Elon Musk, Andy Warhol, Mark Zuckerberg, Picasso, and even Beeple himself.

Of course, it’s not just about the eerie visual effect. These robotic dogs use cameras on their heads to observe their surroundings and employ a constantly evolving visual algorithm to create works of art.

The celebrities portrayed by these robotic dogs weren’t chosen randomly. They were selected because they have influenced how humans perceive the world, whether through algorithms, art, or politics. We, as humans, observe the world through these perspectives, and so do these robotic dogs. At Art Basel, these robotic dogs and humans observed each other, and each moment of observation became an artwork created by the robotic dogs—artworks that are like autobiographies of these robotic dogs.

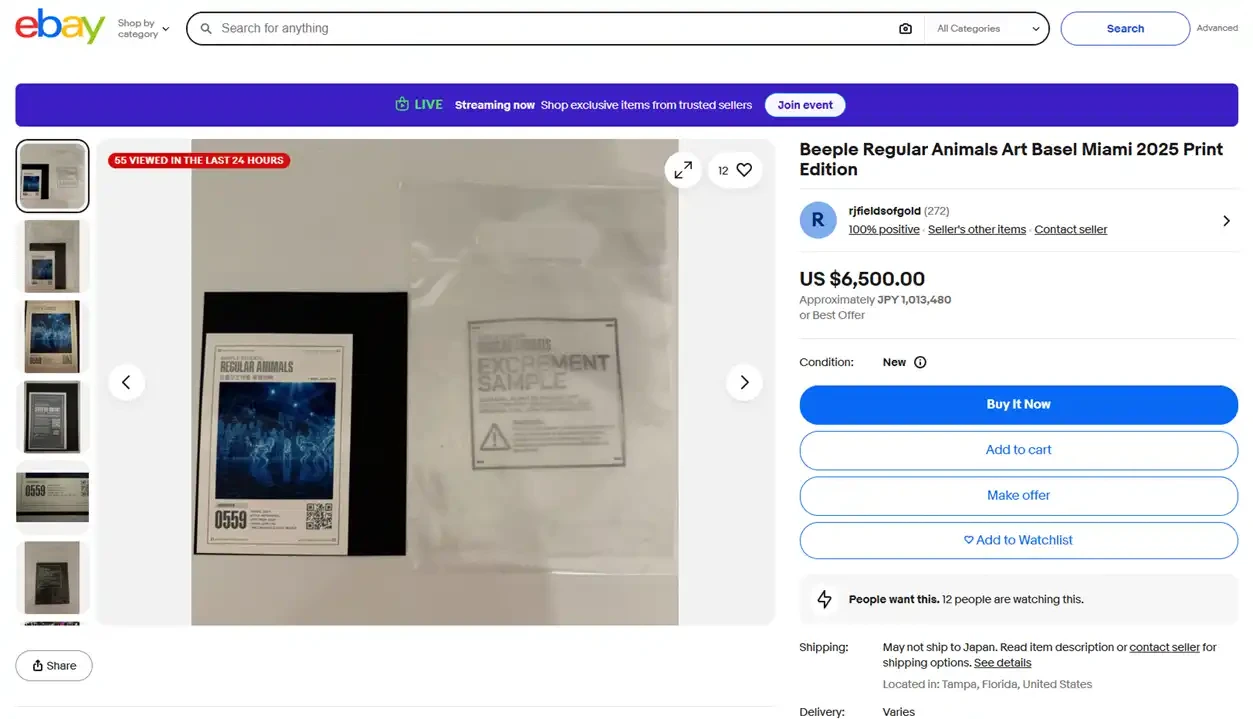

Interestingly, Regular Animas also has a physical series, comprising 1024 pieces. On eBay, one has already been listed for a fixed price of $6500. The market’s pricing strategy suggests that NFTs are far more valuable than physical artworks, reminiscent of Damien Hirst’s “The Currency” series from years ago, which forced owners to choose between physical pieces and NFTs.

Before his huge success in the NFT field, Beeple had been creating artwork every day since 2007, but had never sold a piece for more than $100. After achieving fame and fortune, Beeple did not squander his wealth like some artists or mật mãcurrency project teams. Instead, he built a studio/gallery of about 460 square meters, assembled a team of dozens of 3D artists, engineers, and researchers (including a former Boeing engineer), invited Carolyn Christov-Bakargiev, the former director of the Rivoli Castle Museum of Contemporary Art, as an advisor, and continuously exhibited his work in art exhibitions around the world while creating new artworks.

Beeple’s robot dog exhibition not only garnered attention in the cryptocurrency community due to its price, but also received coverage from traditional media outlets such as the WSJ.

Bài viết này được lấy từ internet: Beeple’s “Golden Dog” in the NFT Winter: Breaking the Mold with an Algorithmic Robot Dog

Related: The Airdrop Hunter’s Arsenal: Six Key Indicators for Screening Truly High-Potential Projects

Compiled by Odaily Planet Daily ( @OdailyChina ) Translator | Dingdang ( @XiaMiPP ) Crypto airdrops may seem like “free money,” but seasoned crypto enthusiasts know that not every airdrop is worth the gas and effort invested. Over the past 5–7 years, I’ve participated in dozens of airdrops, some of which resulted in six-figure profits, while others left me with nothing. The difference lies in whether a sufficient assessment has been conducted. In this report, I will attempt to provide a framework for assessing airdrop potential. I’ve developed a relatively objective evaluation system to determine whether an airdrop opportunity is worth participating in or should be skipped. I’ll combine real-world examples (from the legendary Uniswap airdrop to the latest L2) and some quantifiable benchmarks to provide professional crypto practitioners and…