Author|Wenser (@ وینسر 2010)

2026: Survival is Paramount.

In our previous article, “2026, Survive: A Bear Market Survival and Counterattack Manual for Crypto Enthusiasts”, we systematically outlined this year’s “survival strategies,” emphasizing the allocation of assets like gold and other precious metals as a key component. For those aiming to hedge against inflation, mitigate fiat currency devaluation, and address issues like the declining USD exchange rate through gold, the next challenge becomes how to allocate gold-related assets.

In this regard, based on the author’s personal understanding, XAUT, issued by Tether, might be the optimal pathway for کرپٹو-savvy individuals to allocate gold assets. Considering the recent introduction of the new accounting unit “Scudo” for Tether Gold (XAU₮) by Tether, the entry barrier for gold token allocation has also sharply dropped to as low as a few dollars.

Odaily will systematically analyze in this article whether XAUT is worth allocating a position to.

Potential Support for Gold’s Rise: US Policy, ETF Inflows, Bank Ratings

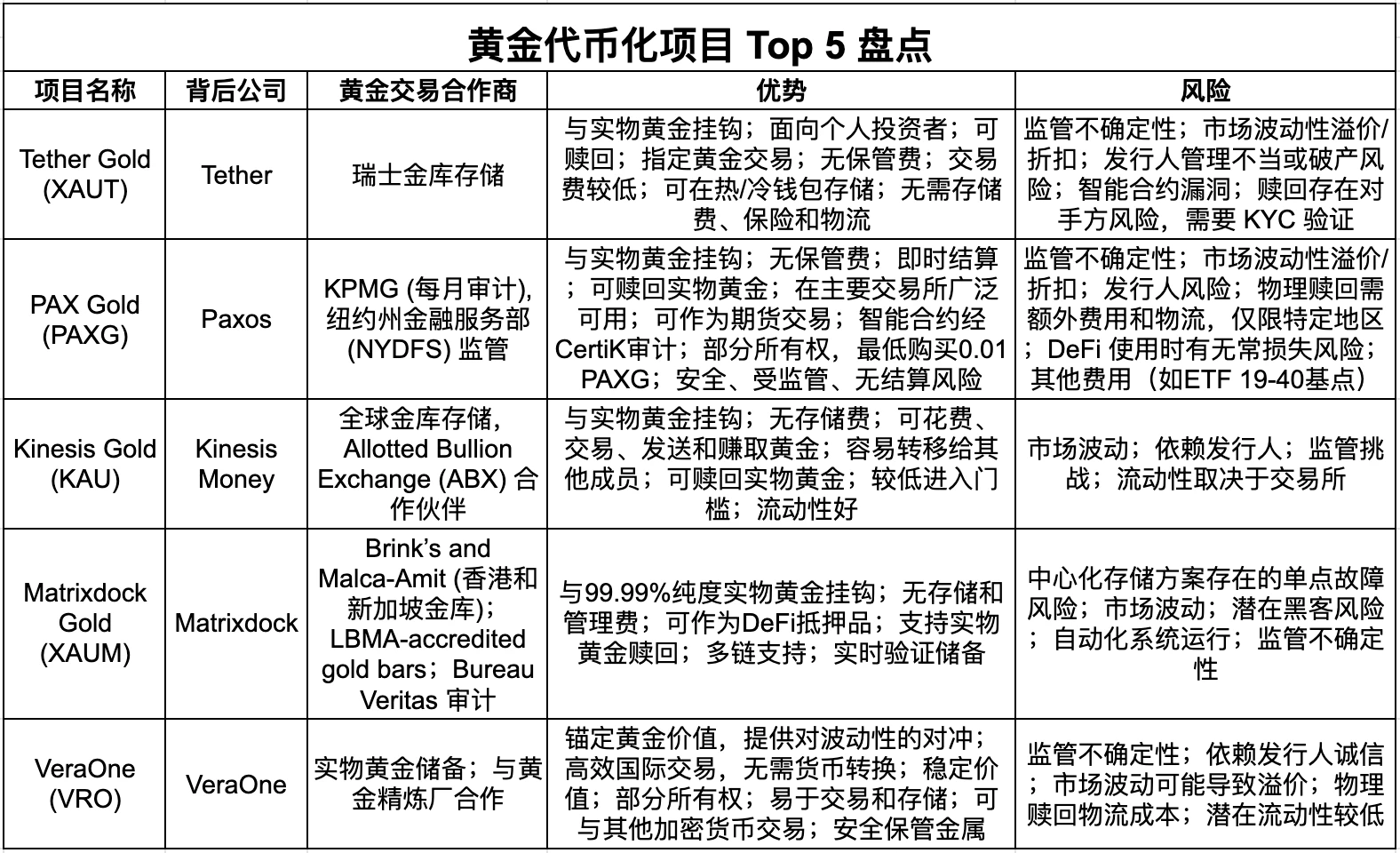

Last September, when the spot gold price was still hovering around $3400-$3500, we systematically introduced five major gold tokens in the article “Gold Price Expected to Continue Surging to $3900/oz, A Rundown of 5 Major Gold Tokens”, with XAUT being one of them. Looking back three months later, the spot gold price per ounce once surged to around $4550. It has to be said, the momentum is formidable.

Furthermore, despite recent phased price corrections, the upward trend of spot gold has not been significantly disrupted. Specifically, the support for gold prices stems from the following aspects:

World Gold Council: Three Factors Including US Supreme Court Tariff Decision Only Constitute Short-Term Volatility Impact on Gold’s Future Trend

The World Gold Council released a report stating that the surge in precious metals (including silver and platinum) in December and the rebalancing of commodity indices may trigger market volatility in the short term. However, apart from short-term volatility impacts, gold is expected to continue following its own operational logic. The impending ruling by the US Supreme Court on tariff policies could have a significant impact on US trade policy. Its effect on gold may be more complex but could constitute potential support. Finally, ongoing geopolitical conflicts (with recent US actions in Venezuela being the latest example) also provide support for gold prices.

Gold Price Set 53 New Historical Records in 2025, ETFs Saw Unprecedented Inflows

The World Gold Council indicated that as the gold price set 53 new historical records in 2025, global investors poured unprecedented funds into gold ETFs. North American funds contributed the main part of global inflows in 2025. Meanwhile, gold holdings in the Asian region nearly doubled, and Europe also showed significant demand.

Gold Rose Approximately 65% in 2025 with Over 50 New Highs, Silver Rose About 150%

2025 precious metals market performance showed that spot gold closed down 0.46% on December 31st, at $4318.65 per ounce. Against the backdrop of global “de-dollarization,” the Federal Reserve restarting its rate-cutting cycle, and continued gold purchases by central banks worldwide, gold became the most dazzling “star asset” of 2025, with a sustained rally throughout the year, rising approximately 65% annually, once refreshing its historical high to $4549.96 per ounce, and setting over 50 new highs within the year.

UBS Group: Raises Gold Price Targets for March, June, and September 2026 to $5000 per Ounce

UBS Group stated it remains bullish and has raised its gold price targets for March, June, and September 2026 to $5000 per ounce (previously $4500 per ounce). It expects the gold price to decline slightly to $4800 per ounce by the end of 2026.

Based on the above information, gold’s performance is viewed favorably for the coming year. Now, let’s discuss why Tether’s gold token XAUT is worth allocating.

4 Major Advantages of XAUT Allocation: High بازار Cap, Low Barrier, Good Liquidity, Leverage Available

First, Tether’s substantial financial backing and the gold reserves and ample liquidity behind XAUT.

At the beginning of the month, Tether CEO Paolo Ardoino بیان کیا that Tether purchased 8888 Bitcoins on New Year’s Eve 2025, worth approximately $780 million. This transaction increased the stablecoin issuer’s publicly disclosed Bitcoin holdings to over 96,000. Tether currently allocates 15% of its quarterly profits to Bitcoin regularly. Furthermore, Tether purchased 26 tons of gold in Q3 2025, bringing its total gold holdings to 116 tons, ranking among the top 30 global gold holders. A market cap of around $2.3 billion is also clear evidence of XAUT’s sufficient liquidity.

Second, Tether’s recent introduction of the new accounting unit “Scudo” for XAUT.

کے مطابق official announcement, Tether has officially launched the new pricing unit Scudo for Tether Gold (XAUT). This unit aims to reintroduce gold as a means of payment. One Scudo is defined as one-thousandth of a troy ounce of gold or one-thousandth of an XAUT token (approximately $4.4). This move addresses the issue of users dealing with long decimal places during transactions or pricing by introducing a simpler pricing method, making gold more practical in daily economic activities. Tether Gold is currently fully backed by physical gold in secure vaults. The introduction of Scudo does not alter XAUT’s structure or backing method.

Third, XAUT is listed on major mainstream CEX and DEX platforms and supports spot purchases or leveraged contract operations.

کے مطابق Coingecko information, XAUT supports buying and selling on CEXs like Bybit, OKX, Bitget, and DEXs like Uniswap, Fluid, and Curve.

Finally, Tether’s dominant position in the stablecoin track and the exceptionally high profitability of its business operations also provide strong support for XAUT’s growth and development. Its industry adoption is expected to see further improvement in 2026.

According to Bloomberg citing Artemis Analytics data, global stablecoin transaction volume surged 72% year-on-year in 2025, reaching a record $33 trillion. Among them, USDC issued by Circle had a transaction volume of $18.3 trillion, ranking first; Tether’s USDT transaction volume was $13.3 trillion, also maintaining a high level. Together, they account for the vast majority of stablecoin trading activity.

Considering the ongoing decline in the USD to CNY exchange rate, for the majority of ordinary people with relatively limited capital and lower investment risk appetite, converting some fiat currency into the gold token XAUT might be a relatively better solution.

یہ مضمون انٹرنیٹ سے لیا گیا ہے: Is Tether’s Gold Token XAUT Worth Buying?

Related: Solana officially named 12 noteworthy new projects.

Encryption computation Arcium On March 27, the encrypted computing network Arcium announced the completion of its angel round of financing, with investors spanning multiple sectors, including some community fundraising through Echo. The total funding has now reached $11 million. Participants included Jupiter co-founder Meow, MegaETH founding team member namik, and Jupiter co-founder Siong. Arcium started as Elusiv, a privacy protocol on Solana, and later evolved into a broader privacy computing platform. Using MPC and ZKP technologies, it allows computation on encrypted data without exposing the data content. In an Arcium network, MXEs (Multi-Party Execution Environments) are responsible for securely executing computational tasks. Users can configure the encryption protocols used for each MXE individually and on demand. arxOS is the distributed execution engine within the Arcium network, responsible for coordinating computation…