Strategy snapped up 10,000 BTC in a single week. How many are still available on the market?

Author | Dingdang ( @XiaMiPP )

Over the past two weeks, Strategy has once again increased its Bitcoin holdings at an astonishing pace: adding more than 10,000 coins in a single week, worth over $900 million.

As a well-known long-term holder in the market, despite the continuous decline in Bitcoin prices and its own mNAV falling below 1, Strategy has not sold off as the market feared; instead, it has taken the opposite approach—firmly buying. To date, Strategy holds approximately 671,000 Bitcoins, with a total value exceeding $50 billion, further solidifying its position as one of the world’s largest Bitcoin holders.

This move has also prompted deeper reflection in the market: with such large-scale and continuous buying, how much Bitcoin is actually available for trading in the market?

While the theoretical maximum supply of Bitcoin is 21 million, the actual circulating supply is far less. Currently, approximately 19.96 million Bitcoins have been mined, representing 95% of the total supply, leaving only about 1.04 million unmined. The current block reward is 3.125 BTC, with an average daily increase of about 450 Bitcoins, and it will halve again in 2028. At this rate, the last Bitcoin is expected to be mined around 2140.

However, what truly determines market supply is not the unproduced new currency, but the liquid portion of the existing currency.

Statistics show that over 30% of Bitcoin has remained unmoved for an extended period, considered “dormant holdings”; another 20% is suspected of being permanently lost. Furthermore, the proportion of Bitcoin held by institutions and public funds, including listed companies, ETFs, and government funds, continues to rise, with most of these BTC exiting high-frequency trading. In addition, the amount of Bitcoin in circulation on exchanges has fallen to a multi-year low, meaning that the “floating supply” available for immediate sale is rapidly shrinking. With whales quietly accumulating Bitcoin and long-term holders reluctant to sell, market liquidity is facing a structural tightening.

Crypto analyst Murphy has systematically analyzed the question of Bitcoin’s true circulating supply. Odaily Planet Daily further integrates data and perspectives to present a comprehensive picture of the data behind this scarcity narrative—as buying power continues while the available supply shrinks, the market landscape may be quietly shifting.

The “institutionalized hoarding” by long-term holders is taking over the circulating shares.

Long-term holders have become the most important structural force in the Bitcoin market. According to Glassnode, this group holds approximately 14.35 million BTC, accounting for over 70% of the circulating supply.

Further analysis reveals that there are currently 153 companies holding a non-zero BTC balance, with 29 of them being the most significant, holding a total of 1.082 million Bitcoins (of which “Other” holds 54,331). Among these 29 listed companies, Strategy alone holds 671,000 BTC, accounting for a staggering 62% .

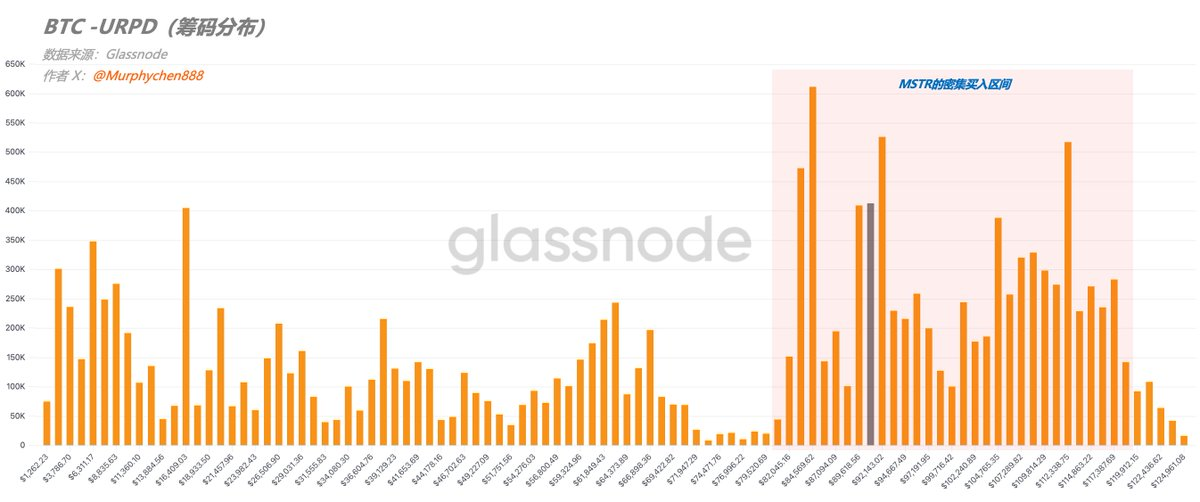

If we combine this with URPD (UTXO Realized Price Distribution) data, Strategy’s concentrated buying range coincides with the most densely accumulated area in the BTC price structure, roughly between $80,000 and $118,000. This means that Strategy did indeed play a significant role in the large-scale turnover at higher price levels. This is why MSTR and ETFs are considered the driving force behind this bull market cycle.

It’s worth noting that on October 6th, only 67 companies held “non-zero BTC balances,” but with the significant correction in BTC’s price, this number surged to 153. Does this mean that new corporate players are quietly entering the market during the price decline?

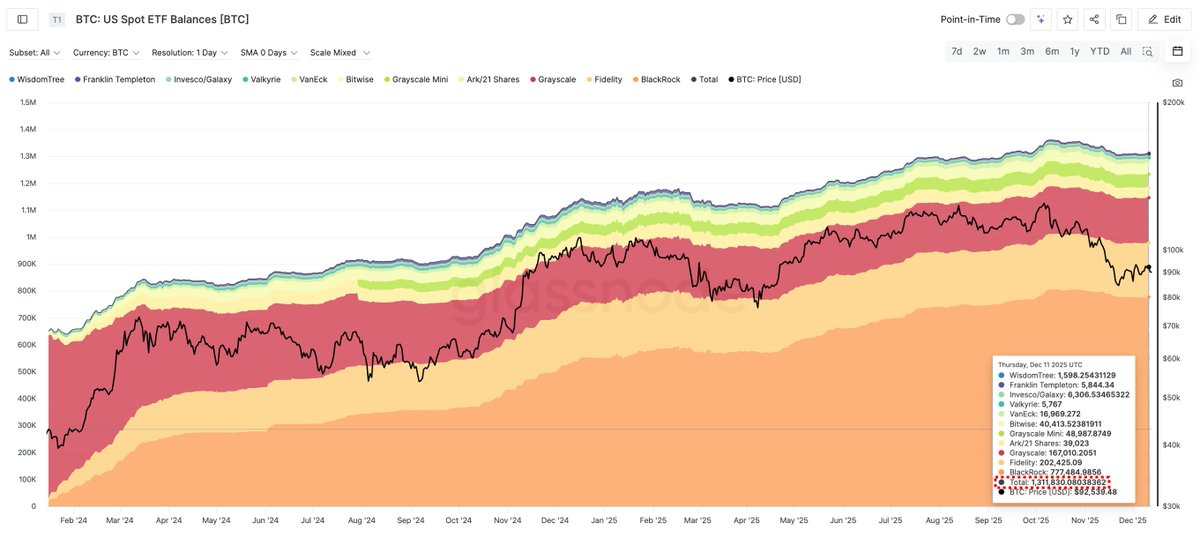

Besides the BTC held by physical businesses, as of now, spot Bitcoin ETFs hold a total of approximately 1.311 million BTC. The top three holders are: BlackRock with approximately 777,000 BTC, Fidelity with approximately 202,000 BTC, and Grayscale with approximately 167,000 BTC.

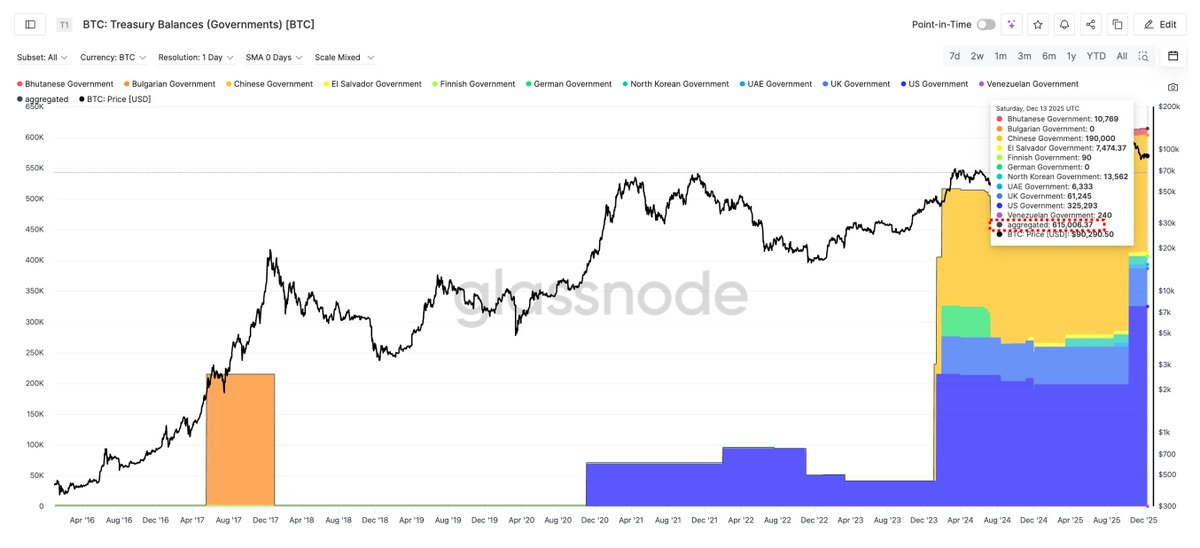

In addition, governments worldwide hold approximately 615,000 Bitcoins. The US government holds the largest stake with 325,000, while the Chinese government ranks second with approximately 190,000 BTC. It should be noted that the Chinese government has never officially disclosed its holdings; this data primarily comes from Glassnode, and its statistical methods may differ from actual figures.

In addition, the number of Bitcoins held for more than 10 years without any movement is approximately 3.409 million . This portion of assets includes both early exchange cold wallets and true “OG” (Original God) tokens; however, it is equally important to note that a significant portion of these may have actually left the circulation system due to reasons such as lost private keys or the death of the holder, including approximately 1 million BTC that are widely believed to belong to Satoshi Nakamoto.

Of the mined BTC, how much is actually “unavailable for purchase”?

Murphy subsequently provided a more detailed analysis of this data. Because Bitcoin doesn’t have a “forgot your password” feature like traditional bank accounts, it relies entirely on private keys to prove ownership. Once a private key is lost or inaccessible, the corresponding Bitcoins are permanently unmovable and cannot be spent. Although they are still recorded on the blockchain, economically speaking, they are equivalent to being permanently destroyed.

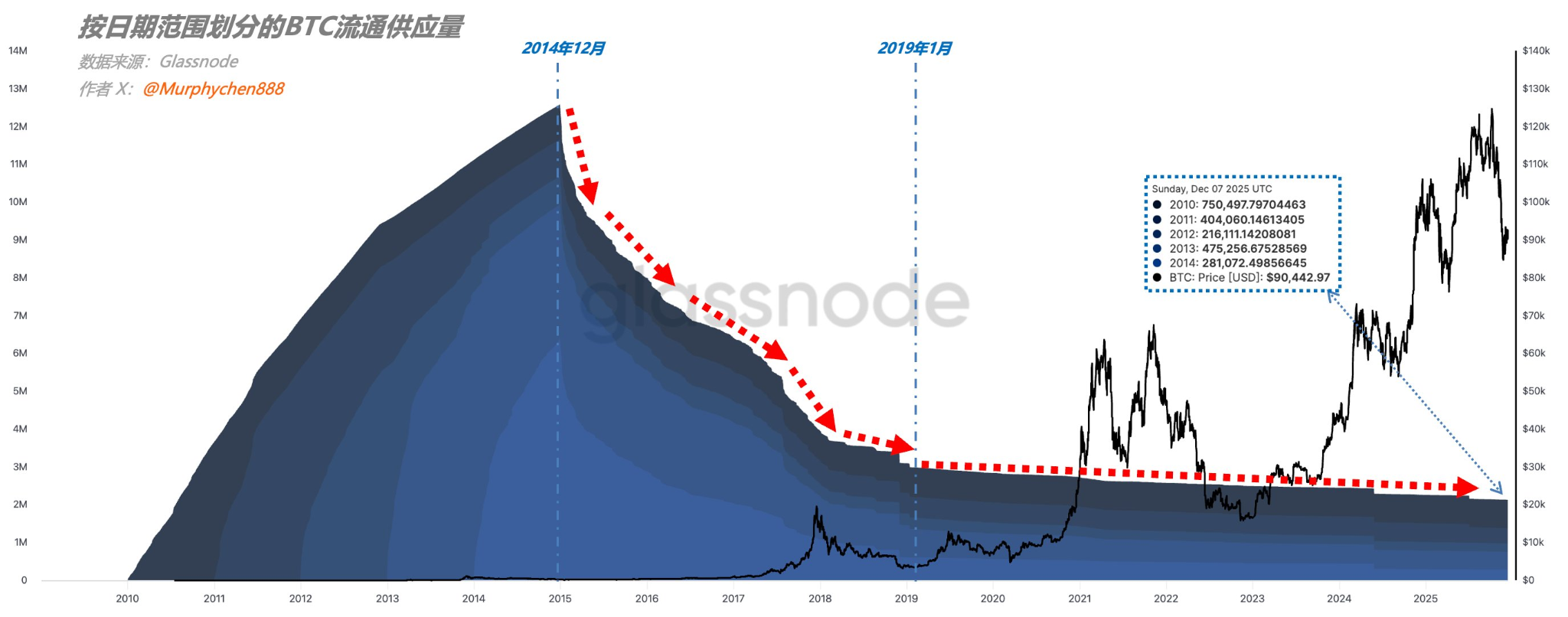

If we break down the circulating supply by date range, where each date range refers to the creation date of a UTXO, we can see that the cumulative peak of BTC, which was “born” between 2010 and 2014, occurred in December 2014, after which it declined rapidly (as it was spent); and since January 2019, there has been almost no significant change.

Most of these ancient Bitcoins that have survived to this day, except for those held by absolute believers, have likely been lost. According to Murphy’s estimate, this proportion is at least 50%, or at least 1.06 million Bitcoins .

There is also a group of coins called “Supreme Kings,” whose UTXO was created in 2009. It has been almost untouched since December 2011, and to this day, this address group holds 1.08 million BTC.

In other words, at least approximately 2.14 million BTC may be permanently immobile.

The actual flow of supply

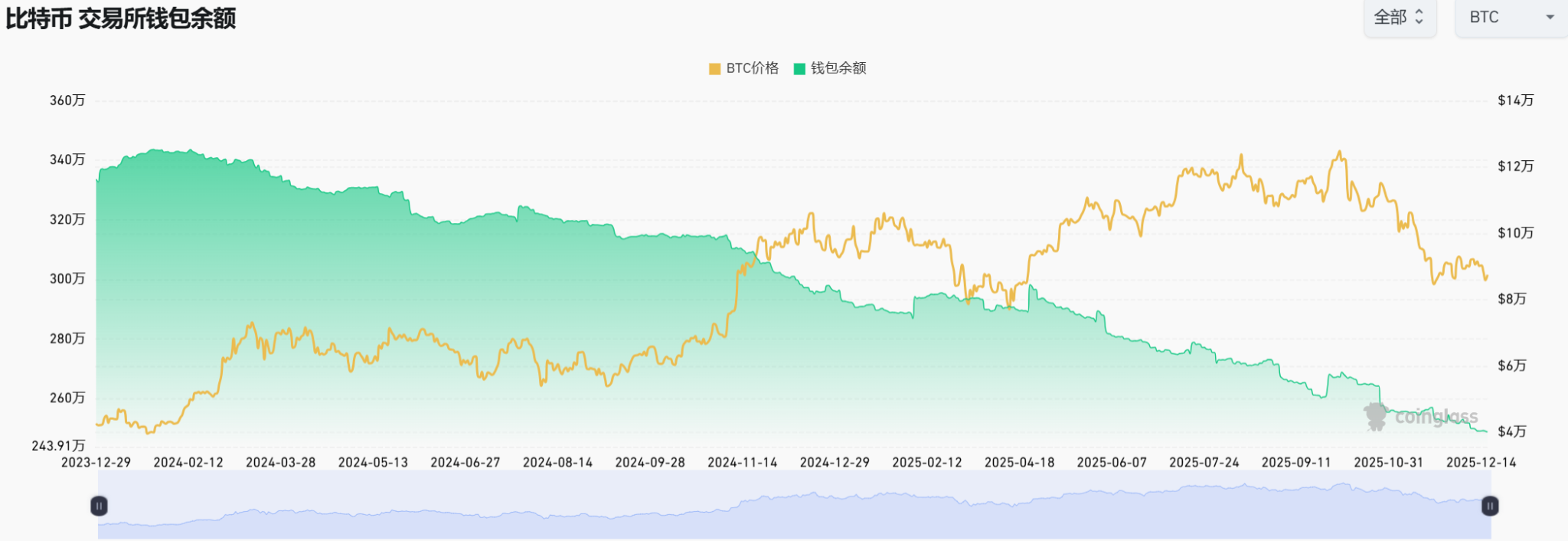

Looking at the most direct indicator— exchange balances —there are currently about 2.49 million Bitcoins held in exchange wallets, and this trend is continuing to decline, reaching a new low since 2023.

In other words, while demand is becoming increasingly “institutionalized,” supply is shrinking, and the pool of Bitcoin available for trading is becoming smaller and smaller.

यह लेख इंटरनेट से लिया गया है: Strategy snapped up 10,000 BTC in a single week. How many are still available on the market?

Author | Asher ( @Asher_0210 ) RareBetSports: Prediction बाज़ार Sector RareBetSports is a sports prediction market platform that allows users to predict the performance of individual athletes, such as player scores, rather than just which team will win a game. On the RareBetSports platform, users can create a lottery called “RareLink,” as follows: Select athletes: Instead of betting on a team to win, users can place bets on specific players; Make a prediction: Determine whether the score of the player you are betting on is greater than or less than the target score; “Skewing” multiple players: Users can select the score data of 2 to 7 different players to create a lottery. In addition, RareBetSports officially stated that the Alpha version will also be launched today. Levr.Bet: Prediction Market Sector…